Tax burdens vary dramatically across the United States, with some states claiming significantly more of residents' income than others. From New York's notoriously high income taxes to California's steep rates and New Jersey's property tax challenges, these states lead America in overall taxation.

Tax policy remains one of the most significant differences between states across America. While some states pride themselves on low taxation and minimal government, others maintain substantially higher tax rates to fund expanded public services, infrastructure, and social programs. For residents and businesses considering relocation, understanding which states impose the highest tax burdens can significantly impact financial planning and quality of life.

This analysis examines the states with the heaviest overall tax burden, considering the combined impact of income taxes, property taxes, sales taxes, and other levies that affect residents' bottom lines. Beyond just identifying high-tax locations, we'll explore what drives these taxation levels and what residents receive in return.

Measuring Tax Burden: How States Are Ranked

Tax burden represents the total amount of taxes paid by residents as a percentage of their income. This comprehensive measure goes beyond simply looking at tax rates, as it considers what people actually pay across all major tax categories:

- Income taxes (state and local)

- Property taxes on real estate

- Sales and excise taxes on purchases

Organizations like the Tax Foundation and WalletHub analyze these factors to create rankings that show the true cost of taxation across states. Rather than focusing solely on one tax type (like income tax rates), these methodologies provide a more complete picture of residents' financial obligations to state and local governments.

The 10 States With the Highest Tax Burdens

Based on comprehensive analyses of total tax burden as a percentage of income, these ten states consistently rank as having the highest overall taxation:

- New York - Total tax burden: approximately 12.7% of income

- Hawaii - Total tax burden: approximately 12.4% of income

- Vermont - Total tax burden: approximately 11.5% of income

- Maine - Total tax burden: approximately 11.0% of income

- Connecticut - Total tax burden: approximately 10.8% of income

- New Jersey - Total tax burden: approximately 10.7% of income

- Rhode Island - Total tax burden: approximately 10.5% of income

- California - Total tax burden: approximately 10.3% of income

- Minnesota - Total tax burden: approximately 10.2% of income

- Illinois - Total tax burden: approximately 9.9% of income

Note that these percentages represent the combined effect of all major state and local taxes, averaged across all residents. Individual tax burdens may vary significantly based on income level, property ownership, and consumption patterns.

Income Tax Leaders: Progressive Tax States

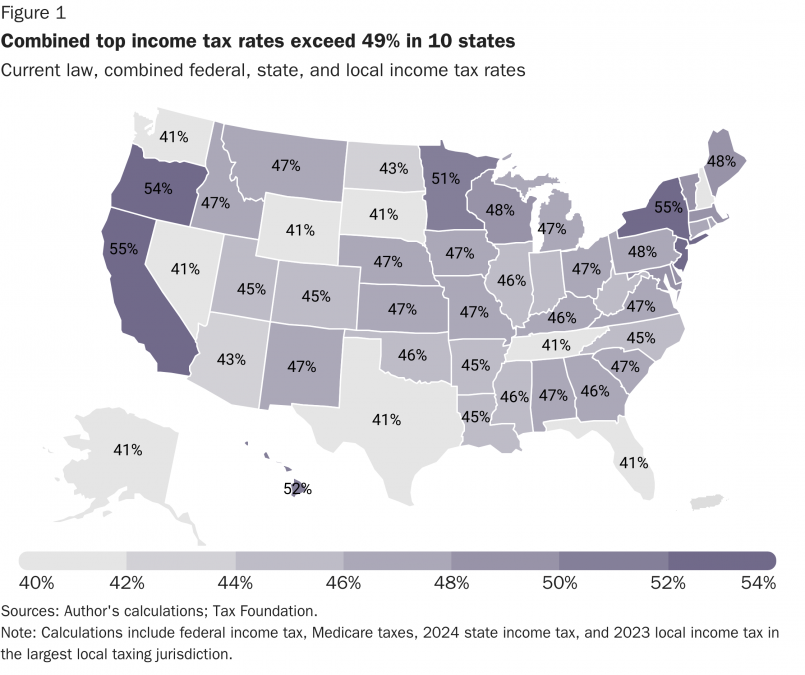

Several states stand out for particularly high income tax rates, especially for high-income earners:

California leads the nation with a top marginal income tax rate of 13.3% for individuals earning over $1 million annually. The state's progressive tax structure imposes increasingly higher rates as income rises, with even middle-income earners facing relatively high rates.

New York combines a state income tax (with a top rate of 10.9%) with local income taxes, including New York City's additional income tax that can push the combined rate to nearly 15% for high-income city residents.

New Jersey, Oregon, Minnesota, and Hawaii all maintain top marginal rates exceeding 9%, significantly higher than the national average.

It's worth noting that seven states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming) have no state income tax at all, creating a stark contrast with these high-tax jurisdictions.

Property Tax Champions: Where Homeowners Pay Most

Property taxes represent a major financial burden for homeowners in certain states:

New Jersey consistently ranks as having the nation's highest effective property tax rate, with homeowners paying an average of 2.49% of their home's value annually. For a median-priced home of $335,000, that translates to over $8,300 per year.

Illinois follows closely with an effective property tax rate of approximately 2.27%, placing significant pressure on homeowners despite relatively modest home values in many parts of the state.

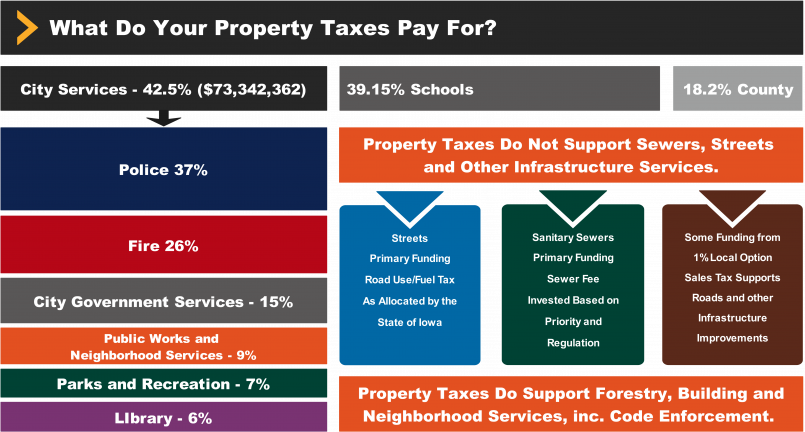

Other states with notably high property tax rates include Connecticut (2.14%), New Hampshire (2.18%), and Vermont (1.90%). These high property tax jurisdictions often use these revenues to fund public schools and local government services.

Property taxes are particularly significant because they are assessed regardless of income or ability to pay, creating challenges for retirees and others on fixed incomes living in areas with rapidly appreciating property values.

Sales Tax Highs: Consumption Tax Leaders

Sales taxes affect everyday purchases and can significantly impact overall tax burden, especially for lower and middle-income residents:

Tennessee has the highest combined state and average local sales tax rate at approximately 9.55%, despite having no income tax. The state relies heavily on consumption taxes to fund government operations.

Louisiana (9.55%), Arkansas (9.51%), Washington (9.29%), and Alabama (9.22%) round out the top five highest combined sales tax rates.

What makes sales taxes particularly noteworthy is their regressive nature - lower-income households typically spend a higher percentage of their income on taxable goods, meaning these taxes take a larger proportional bite from those least able to afford it.

Five states (Alaska, Delaware, Montana, New Hampshire, and Oregon) have no state sales tax, though Alaska allows local sales taxes in some jurisdictions.

Why Are Taxes High in These States?

Several factors contribute to higher taxation levels in certain states:

- Public services: High-tax states often provide more extensive government services, including education, healthcare, and social welfare programs.

- Infrastructure needs: States with aging infrastructure, harsh weather conditions, or dense urban areas face higher costs to maintain roads, bridges, public transit, and utilities.

- Cost of living: States with higher costs of living generally require more revenue to provide competitive salaries for public employees and maintain services.

- Public employee benefits: Some high-tax states have significant pension and healthcare obligations for current and retired public workers.

- Political philosophy: States with more progressive political environments tend to favor higher taxation to fund more extensive government programs.

It's worth noting that higher taxes don't necessarily translate to poorer economic performance. Several high-tax states like New York, California, and Massachusetts also have strong economies and high per capita incomes, though taxation does affect migration patterns and business decisions.

Recent Tax Policy Trends and Changes

Tax policies aren't static, and several noteworthy changes have occurred in recent years:

California has introduced additional high-income tax brackets, further increasing taxes on the wealthy while maintaining its position as the state with the highest top marginal income tax rate.

New York temporarily increased its top income tax rate to 10.9% for incomes above $25 million, scheduled to expire after 2027.

Connecticut has been gradually reducing its estate tax exemption to align with the federal exemption, providing some relief for wealthy residents.

The SALT deduction cap (limiting the state and local tax deduction to $10,000 on federal tax returns) implemented in 2017 has particularly affected residents of high-tax states, effectively increasing their total tax burden by reducing federal deductions.

Several high-tax states have experienced net population outflows in recent years, with some residents citing tax burden as a motivation for relocating to lower-tax jurisdictions, particularly after remote work became more widespread following the COVID-19 pandemic.

Frequently Asked Questions About 10 States With the Highest Tax Burden in America: Where Your Money Goes

Which state has the highest overall tax burden?

New York consistently ranks as the state with the highest overall tax burden, with residents paying approximately 12.7% of their income in state and local taxes. This high burden comes from a combination of substantial income taxes (including additional NYC taxes for city residents), high property taxes, and significant sales taxes.

Do high-tax states provide better services?

High-tax states generally provide more extensive government services, but quality varies. States like Massachusetts and Minnesota often rank high in education and healthcare outcomes, justifying some of their higher taxes. However, the correlation isn't perfect - some high-tax states struggle with inefficiency or legacy costs like pension obligations that consume tax dollars without improving current services.

Are property taxes or income taxes more burdensome?

This depends on individual circumstances. For high-income earners, income taxes (especially in states like California with rates exceeding 13%) often represent the largest tax burden. For retirees with modest incomes but valuable homes, property taxes (particularly in states like New Jersey or Illinois) can be more challenging since they're based on property value, not ability to pay.

How do local taxes affect the overall tax burden?

Local taxes significantly impact overall tax burden but are often overlooked. Cities like New York, Philadelphia, and San Francisco impose their own income taxes on top of state taxes. County and municipal property tax rates vary dramatically within states. Some cities also have local sales taxes that can add 2-4% to the state rate, substantially increasing the cost of purchases.

Are people really leaving high-tax states?

Census data shows net population outflows from several high-tax states like New York, California, Illinois, and New Jersey in recent years. While taxes aren't the only factor (housing costs and climate also matter), tax considerations do influence migration decisions, especially for high-income retirees and increasingly for remote workers who can maintain their jobs while relocating to lower-tax jurisdictions.

How did the SALT deduction cap affect high-tax states?

The $10,000 cap on state and local tax (SALT) deductions implemented in 2017 significantly increased the effective tax burden for many residents of high-tax states. Previously, taxpayers could deduct unlimited amounts of state and local taxes from their federal returns, which partially offset high state taxes. The cap particularly affected upper-middle and high-income households in states like New York, New Jersey, and California.