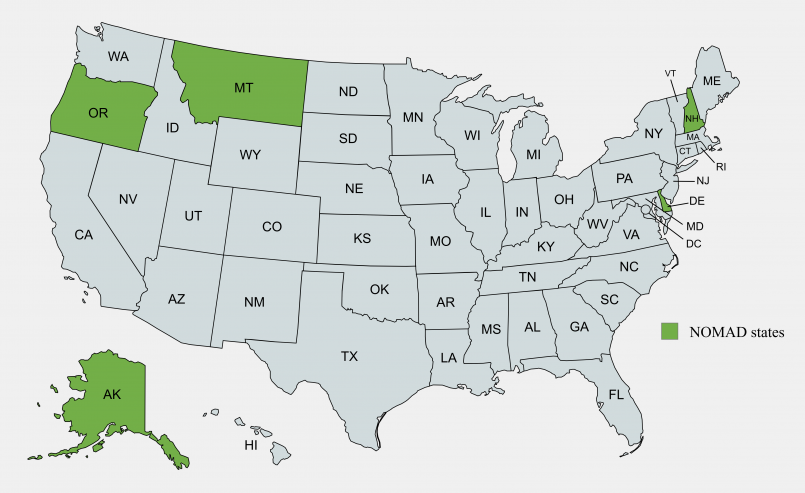

Five U.S. states-Alaska, Delaware, Montana, New Hampshire, and Oregon-have chosen to forgo sales taxes entirely. This policy decision shapes their economies, attracts certain businesses, and requires alternative revenue sources to fund state operations.

When you shop in most U.S. states, you expect to pay extra at checkout-the sales tax that funds various government services. However, a select group of states operates differently, having chosen to forgo sales taxes entirely. This decision shapes not just shopping experiences, but entire state economies and government funding structures.

These sales tax-free states have developed alternative fiscal strategies that set them apart from their neighbors, creating unique economic environments and sometimes fierce competition for retail dollars. Let's explore which states have eliminated sales tax, why they made this choice, and how it affects their residents and visitors.

Which States Have No Sales Tax?

Five U.S. states currently operate without a statewide sales tax:

- Alaska - Though it has no state sales tax, many local jurisdictions impose their own sales taxes

- Delaware - Completely sales tax-free at both state and local levels

- Montana - No state sales tax, though some tourist areas have resort taxes

- New Hampshire - Maintains a "Live Free or Die" philosophy that extends to taxation

- Oregon - Has consistently rejected sales taxes through multiple voter referendums

It's worth noting that while Alaska has no state sales tax, local municipalities can implement their own sales taxes, creating a patchwork system across the state. The other four states maintain complete exemption from sales tax at all levels of government.

Why Some States Choose No Sales Tax

The decision to forgo sales taxes stems from various historical, philosophical, and practical considerations:

- Political philosophy - Many of these states embrace a limited government approach

- Economic strategy - Attracting shoppers from neighboring states creates a competitive advantage

- Alternative revenue sources - Natural resources or tourism may provide sufficient funding

- Historical precedent - Some states never implemented sales taxes when they became common elsewhere

- Voter preference - Citizens have repeatedly rejected sales tax proposals

New Hampshire's "Live Free or Die" motto reflects its broader approach to taxation, while Delaware has built a significant part of its identity around being tax-free for shoppers. These states have made deliberate policy choices that align with their citizens' values and economic goals.

Alternative Revenue Sources

States without sales taxes must find other ways to fund government operations. Each has developed its own approach:

- Alaska - Heavily relies on oil and natural resource revenues

- Delaware - Collects substantial revenue from corporate fees and franchise taxes

- Montana - Depends on natural resource taxes and a progressive income tax

- New Hampshire - Uses high property taxes and business taxes

- Oregon - Implements higher personal income taxes than many states

Delaware's position as a corporate headquarters haven generates significant revenue through business registration fees, with over 60% of Fortune 500 companies incorporated there. Meanwhile, Alaska has historically funded much of its government through oil revenues, even distributing annual dividend payments to residents through its Permanent Fund.

Economic Impacts

The absence of sales tax creates several economic effects:

- Lower prices for consumers on retail purchases

- Potential advantage for retailers near state borders

- Regressive tax relief (benefits lower-income households proportionally more)

- Competition for retail dollars from neighboring states

- Potential volatility in state revenues depending on alternative sources

For residents, the lack of sales tax provides immediate benefits at the register. However, these states often compensate with higher taxes in other areas. New Hampshire, for example, has among the highest property tax rates in the country, while Oregon's income tax rates exceed national averages.

For businesses, especially retailers near state borders, the sales tax advantage can be substantial. This has led to strategic placement of shopping centers and retail districts directly adjacent to borders with tax-collecting states.

Border Sales and Tourism

The absence of sales tax creates powerful economic incentives around state borders:

- Delaware's shopping centers attract customers from Pennsylvania, Maryland, and New Jersey

- New Hampshire sees substantial cross-border shopping from Massachusetts

- Oregon retailers benefit from Washington residents crossing state lines

- Tourism marketing often highlights tax-free shopping opportunities

The border shopping phenomenon is particularly notable in areas like northern Delaware, where major shopping centers sit just minutes from Pennsylvania and New Jersey, both of which have substantial sales taxes. Similarly, southern New Hampshire hosts large retail developments specifically targeting Boston-area shoppers seeking tax savings on big-ticket items.

Future of Tax-Free States

Several factors may influence the future sustainability of no-sales-tax policies:

- Growth of e-commerce and online sales taxation

- Volatility in natural resource revenues (particularly for Alaska)

- Infrastructure and education funding pressures

- Economic diversification needs

- Federal policy changes

The 2018 Supreme Court decision in South Dakota v. Wayfair changed how states can tax online sales, potentially reducing the competitive advantage of no-sales-tax states. Additionally, states like Alaska that depend heavily on natural resource revenues face challenges as those industries evolve.

Despite these pressures, the no-sales-tax policy has become deeply ingrained in these states' identities and political cultures. Attempts to introduce sales taxes have consistently failed, suggesting these policies will likely persist even as states adapt their broader revenue strategies.

Frequently Asked Questions About 5 States With No Sales Tax: Why They Skip This Revenue Source

Which five states have no sales tax?

The five states that don't collect statewide sales tax are Alaska, Delaware, Montana, New Hampshire, and Oregon. While Alaska has no state sales tax, local municipalities can implement their own sales taxes, creating different rates across the state.

How do states without sales tax fund their governments?

Each no-sales-tax state relies on different revenue sources. Alaska depends heavily on oil and natural resource revenue. Delaware collects substantial business fees and franchise taxes. Montana uses natural resource taxes and income taxes. New Hampshire relies on high property taxes and business taxes. Oregon implements higher personal income taxes than many states.

Do residents of states without sales tax pay higher taxes in other ways?

Yes, in most cases. While consumers benefit from no sales tax at checkout, these states typically compensate with higher taxes in other areas. For example, New Hampshire has among the highest property tax rates in the country, Oregon has relatively high income tax rates, and Alaska residents may face higher local taxes depending on their municipality.

Is online shopping tax-free in these states?

For residents of these states, online purchases are generally exempt from sales tax when buying from in-state sellers. However, following the 2018 Supreme Court decision in South Dakota v. Wayfair, online retailers may be required to collect sales tax based on the buyer's location, even when the retailer has no physical presence in that state. This has somewhat reduced the tax advantage for online shoppers.

Do border towns in tax-free states see economic benefits?

Yes, border towns often experience significant economic benefits. Cities and towns near state borders typically see higher retail sales volumes as shoppers from neighboring tax-collecting states cross the border for major purchases. This has led to strategic development of shopping centers, outlet malls, and retail districts close to state borders to capitalize on this advantage.