From coastal tech hubs to financial centers, these American cities command top dollar for the privilege of calling them home. We explore what makes these locations so expensive and why people continue to pay premium prices to live there.

Living in America's most prestigious cities comes with a hefty price tag. These urban centers offer unparalleled career opportunities, cultural experiences, and amenities that attract residents despite the astronomical costs. While the appeal is undeniable, the financial reality of residing in these locations requires careful consideration of housing costs, transportation expenses, and everyday living expenses.

The following cities represent the most expensive places to live in the United States, where housing markets are competitive, basic necessities command premium prices, and salaries-while often higher than national averages-frequently struggle to keep pace with the cost of living. Let's explore what makes these locations so expensive and why they continue to be desirable despite their high costs.

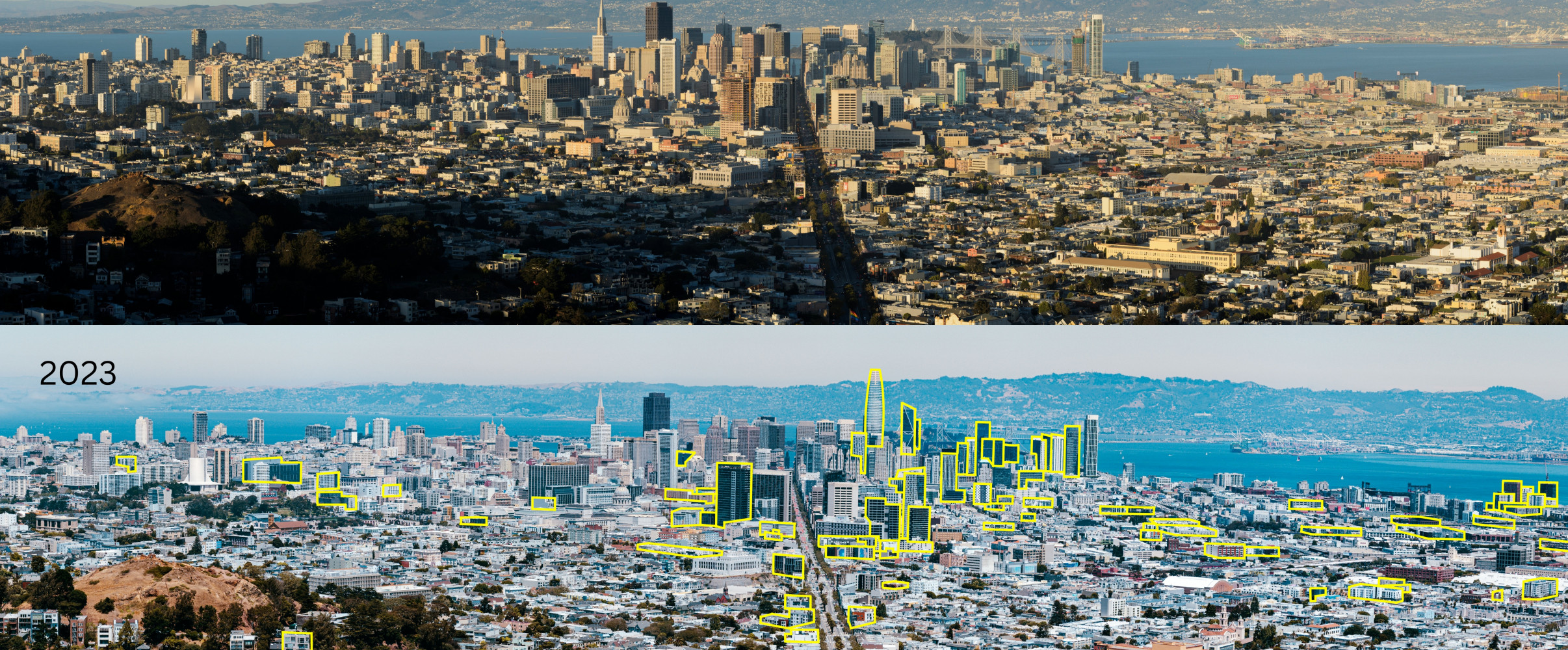

San Francisco, California

Consistently ranking as America's most expensive city, San Francisco's housing market is notorious for its astronomical prices. The median home price exceeds $1.3 million, while average rent for a one-bedroom apartment hovers around $3,000 monthly. The city's limited geographic footprint combined with strict zoning regulations has created severe housing scarcity.

The tech industry dominates San Francisco's economy, with major companies and startups offering high salaries that fuel housing competition. Beyond housing, residents face steep costs for transportation, groceries, and dining, with a typical meal at a mid-range restaurant costing 40% more than the national average.

Despite the costs, San Francisco offers unparalleled career opportunities in technology, stunning natural beauty with views of the Bay and Pacific Ocean, and a rich cultural scene. The city's commitment to progressive policies and innovation continues to attract residents willing to pay the premium.

New York City, New York

The quintessential American metropolis, New York City-particularly Manhattan-remains among the nation's most expensive places to live. Housing costs vary widely by borough, with Manhattan's median home prices approaching $1 million and average rents for a one-bedroom exceeding $3,500 monthly. The outer boroughs offer more affordable options but still exceed national averages substantially.

Beyond housing, New Yorkers contend with high costs for essentials: groceries cost about 28% more than the national average, while utilities and transportation add significant expenses despite the city's extensive public transit system. The city's 8.875% sales tax further increases everyday purchases.

What justifies these costs? New York offers unmatched career opportunities across finance, media, fashion, and the arts. Its cultural institutions, dining scene, and 24-hour lifestyle create an environment many find worth the premium. The city's walkability and public transportation also offset some costs by reducing the need for car ownership.

Honolulu, Hawaii

Island living comes at a premium in Honolulu, where geographic isolation contributes to extraordinarily high costs. Housing prices reflect paradise's limited supply, with median home values around $870,000 and typical one-bedroom apartments renting for approximately $1,700 monthly.

The island's remoteness means virtually everything must be imported, resulting in grocery prices roughly 70% higher than mainland averages. A gallon of milk can cost $7, while gasoline typically exceeds national averages by 30%. Utilities also command premium prices due to high energy costs on the island.

Residents accept these costs for Hawaii's unparalleled quality of life, natural beauty, and unique cultural blend. The tropical climate, outdoor lifestyle, and lower stress environment attract those willing to make financial sacrifices for paradise. Tourism-based employment and military presence provide economic opportunities, though wages often struggle to match living expenses.

Boston, Massachusetts

New England's educational and medical hub commands premium prices, particularly in housing. Boston's median home value exceeds $700,000, while typical one-bedroom apartments rent for around $2,500 monthly. The city's historic character, limited developable land, and strict building regulations contribute to housing scarcity.

Beyond housing, Bostonians face high costs for transportation, healthcare, and groceries. The city's cold winters drive up utility expenses, while parking comes at a premium. Even with these costs, Boston's walkability and public transportation options provide some financial relief for residents.

The city justifies its high costs through exceptional educational institutions like Harvard and MIT, world-class medical facilities, and a robust job market in technology, finance, and biotech. Boston's rich history, cultural amenities, and distinct neighborhood character create a uniquely appealing urban environment that continues to attract residents despite the financial burden.

San Jose, California

As the capital of Silicon Valley, San Jose exemplifies how tech industry prosperity drives up living costs. The city's median home value exceeds $1.1 million, while typical one-bedroom apartments rent for approximately $2,500 monthly. The continued expansion of tech companies creates relentless housing demand that outpaces supply.

Beyond housing, San Jose residents face California's high taxes, expensive utilities, and transportation costs. The car-dependent nature of much of the region adds to household expenses, while groceries and dining typically exceed national averages by 10-20%.

The city's appeal lies in its exceptional career opportunities in technology, with some of the world's highest-paying jobs concentrated in this region. The Mediterranean climate, proximity to both beaches and mountains, and diverse cultural makeup further enhance quality of life for those who can afford it. The substantial wealth generation potential in Silicon Valley helps explain why residents tolerate the extraordinary costs.

Los Angeles, California

The entertainment capital combines high housing costs with substantial transportation expenses. While not quite reaching San Francisco levels, Los Angeles' median home prices exceed $750,000, with typical one-bedroom apartments renting for approximately $2,200 monthly. The sprawling nature of the city creates neighborhood price variations, but few truly affordable options exist.

Los Angeles' car-dependent culture adds significant expenses, with residents facing high automobile costs, insurance premiums, and gasoline prices that typically exceed national averages by 30%. California's state income tax (up to 13.3%) further reduces purchasing power.

Despite these costs, Los Angeles offers unparalleled opportunities in entertainment, media, and creative industries. The year-round sunshine, diverse cultural attractions, and unique lifestyle continue to attract residents. The city's sprawling nature also means more housing options at various price points compared to more geographically constrained expensive cities.

Seattle, Washington

The Pacific Northwest's tech hub has seen dramatic cost increases over the past decade. Seattle's median home prices approach $800,000, while typical one-bedroom apartments rent for approximately $1,900 monthly. The city's limited buildable land, surrounded by water and mountains, constrains housing supply.

While Washington state has no income tax, Seattle's sales tax exceeds 10%, adding costs to everyday purchases. The rainy climate drives up utility expenses, while transportation and groceries typically cost 15-20% above national averages.

Seattle justifies its high costs through abundant high-paying jobs at tech giants like Amazon and Microsoft, plus a thriving startup ecosystem. The city's natural beauty, with water and mountains in every direction, creates an outdoor lifestyle despite the rain. Progressive policies, a vibrant cultural scene, and distinctive neighborhoods maintain Seattle's appeal despite rising costs.

Washington, DC

The nation's capital combines high housing costs with expensive everyday living. Washington's median home values exceed $650,000, while typical one-bedroom apartments rent for approximately $2,100 monthly. The limited height restrictions on buildings (preventing skyscrapers) constrains housing supply in the district.

Beyond housing, DC residents face high costs for transportation, childcare, and healthcare. While the city's extensive public transportation system offers alternatives to car ownership, other living expenses typically exceed national averages by 15-25%.

The district justifies these costs through stable government employment, high-paying jobs in law, lobbying, and international organizations, plus a cultural scene enriched by world-class (often free) museums and institutions. The city's historical significance, walkable neighborhoods, and diverse population create a uniquely appealing urban environment for those who can manage the costs.

San Diego, California

Southern California's beach city combines high housing costs with premium prices for everyday necessities. San Diego's median home values exceed $700,000, while typical one-bedroom apartments rent for approximately $2,000 monthly. The desirable coastal climate and limited development opportunities maintain housing scarcity.

California's high taxes and expensive utilities add to San Diego's cost burden. Transportation expenses remain significant in this car-dependent region, while groceries and dining typically cost 10-15% above national averages.

Residents accept these costs for San Diego's near-perfect climate, stunning beaches, and outdoor lifestyle. The city offers diverse employment opportunities in technology, healthcare, military, and tourism. The relaxed atmosphere, coupled with big-city amenities and proximity to both Mexico and Los Angeles, creates a uniquely appealing quality of life that commands premium prices.

Oakland, California

Once considered the affordable alternative to San Francisco, Oakland has seen dramatic cost increases. The city's median home values exceed $800,000, while typical one-bedroom apartments rent for approximately $2,000 monthly. Oakland's proximity to San Francisco and improved transportation options have driven up demand substantially.

Like other Bay Area cities, Oakland residents face California's high state income taxes, expensive groceries, and significant transportation costs. Even with these expenses, Oakland remains somewhat more affordable than San Francisco while offering similar access to the region's employment opportunities.

Oakland's appeal includes its vibrant cultural diversity, thriving arts scene, and more accessible housing (by Bay Area standards). The city's improved safety, developing restaurant scene, and convenient access to regional employment centers maintain its popularity despite rising costs. Many residents find Oakland's urban character more authentic and diverse than other expensive Bay Area locations.

Miami, Florida

While Florida lacks state income tax, Miami's housing market has seen dramatic price escalation. The city's median home values exceed $450,000 (and much higher in desirable areas), while typical one-bedroom apartments rent for approximately $1,800 monthly. Foreign investment and limited land have driven housing costs upward.

Beyond housing, Miami residents face high insurance costs (particularly homeowners and flood insurance), expensive utilities due to year-round air conditioning needs, and transportation costs in this car-dependent region. Food and entertainment in tourist areas command premium prices.

Miami justifies its costs through its tropical climate, vibrant cultural scene, and international character. The city offers significant employment in tourism, international business, and increasingly technology. The absence of state income tax partially offsets other expenses, while the lifestyle-beaches, nightlife, and diverse cultural influences-creates an environment many find worth the premium.

Boulder, Colorado

This college town turned tech hub combines natural beauty with high costs. Boulder's median home values exceed $750,000, while typical one-bedroom apartments rent for approximately $1,800 monthly. The city's strict growth limits, surrounded by protected open space, severely restrict housing development.

Colorado's taxes are moderate, but Boulder residents face high costs for transportation, healthcare, and groceries. The extreme seasonal temperature variations drive up utility expenses, while dining and entertainment typically exceed national averages by 10-15%.

Boulder justifies its costs through an exceptional quality of life combining outdoor recreation, intellectual stimulation from the university, and a thriving tech and startup ecosystem. The city's commitment to environmental sustainability, walkable downtown, and mountain views create an appealing environment that commands premium prices from those seeking its unique lifestyle advantages.

Austin, Texas

Once celebrated for affordability, Austin has seen dramatic cost increases as tech companies and remote workers flock to the Texas capital. The city's median home values now exceed $550,000 (up dramatically in recent years), while typical one-bedroom apartments rent for approximately $1,500 monthly.

While Texas has no state income tax, property taxes are among the nation's highest, somewhat offsetting this advantage for homeowners. Transportation costs remain significant in this car-dependent city, though utility and grocery expenses typically remain closer to national averages than other expensive cities.

Austin justifies its rising costs through its booming job market in technology and other sectors, vibrant cultural scene centered around music and creativity, and distinctive character that blends Texas traditions with progressive elements. The relatively favorable tax environment and warmer climate attract transplants willing to pay increasing premiums for the Austin lifestyle.

Portland, Oregon

The Pacific Northwest's hipster haven has seen substantial cost increases in recent years. Portland's median home values exceed $500,000, while typical one-bedroom apartments rent for approximately $1,500 monthly. The city's urban growth boundary limits sprawl, constraining housing supply.

Oregon's high income taxes (up to 9.9%) reduce purchasing power, though the state lacks sales tax. Transportation costs remain moderate due to excellent public transit, but healthcare and groceries typically exceed national averages by 10-15%.

Portland justifies its costs through its distinctive urban character with emphasis on sustainability, local businesses, and outdoor access. The city offers significant employment in healthcare, technology, and creative industries. The food scene, coffee culture, and proximity to both mountains and coast create a quality of life many find worth the premium.

Nashville, Tennessee

A newcomer to expensive city lists, Nashville has seen rapid cost increases with its growing popularity. The city's median home values exceed $400,000 (up dramatically in recent years), while typical one-bedroom apartments rent for approximately $1,400 monthly. The influx of remote workers and entertainment industry growth drive housing demand.

Tennessee has no state income tax but compensates with high sales taxes (9.25%). Transportation costs remain significant in this car-dependent city, while entertainment and dining in popular areas command premium prices.

Nashville justifies its rising costs through its thriving music and entertainment industry, growing healthcare sector, and distinctive cultural character. The city's southern hospitality, combined with increasingly cosmopolitan amenities, creates an appealing environment that continues to attract new residents despite escalating expenses. The absence of state income tax partially offsets other cost increases.

Frequently Asked Questions About 15 Most Expensive Cities in the USA to Live In 2024: Housing, Living Costs & More

Why is San Francisco so expensive compared to other US cities?

San Francisco combines several factors that drive up costs dramatically: severe geographic constraints (surrounded by water on three sides), strict zoning laws limiting development, tech industry concentration creating high-income competition for housing, and California's high taxes. The city's 49 square miles cannot expand, while demand continues to grow, resulting in the nation's highest housing costs.

Which expensive US cities offer the best public transportation to help offset costs?

New York City offers the most comprehensive public transportation system, potentially saving residents $10,000+ annually by eliminating car ownership. Boston, Washington DC, and Chicago also have excellent systems that significantly reduce transportation costs. San Francisco's BART and Muni systems provide good coverage despite reliability issues. Most other expensive cities require car ownership, adding to their cost burden.

Are there any affordable neighborhoods left in these expensive cities?

Most expensive cities still have relatively more affordable neighborhoods, though "affordable" is relative. In NYC, parts of Queens and the Bronx offer lower costs. Oakland and Richmond remain cheaper than San Francisco proper. East Boston and Dorchester offer lower prices than downtown Boston. These areas typically involve longer commutes, sometimes higher crime rates, or fewer amenities, representing the tradeoffs for affordability.

How do taxes impact the cost of living in these expensive cities?

Tax burden varies dramatically among expensive cities. California cities (San Francisco, Los Angeles, San Diego) face the nation's highest state income taxes (up to 13.3%). New York City residents pay both state and city income taxes. Meanwhile, Miami, Seattle, and Nashville have no state income tax, partially offsetting other high costs. Property taxes also vary widely, with Texas cities having particularly high rates despite no income tax.

What salary do you need to live comfortably in the most expensive US cities?

Financial experts typically recommend the 50/30/20 rule (necessities/discretionary/savings). In San Francisco, a single person needs approximately $123,000 annually to follow this formula. New York City requires about $95,000, Honolulu $93,000, and Boston $84,000. These figures increase substantially for families, especially those with childcare needs. Many residents spend well beyond the recommended 30% of income on housing just to live in these desirable locations.

Which expensive cities are experiencing the fastest rising costs?

Austin, Nashville, and Boise have seen the most dramatic percentage increases in living costs over the past five years, largely driven by remote work migration during the pandemic. Austin's median home values increased over 40% between 2019-2022. Previously affordable cities like Phoenix, Raleigh, and Columbus are also seeing rapid cost escalation as residents flee traditional high-cost areas, bringing their higher salaries and housing expectations with them.